Mortgage calculator with current balance

Best Mortgage Lenders Independently researched and ranked mortgage lenders. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals.

Extra Payment Mortgage Calculator For Excel

To use it all you need to do is.

. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. To help you see current market conditions and find a local lender current Redmond 15-year and current Redmond 30-year mortgage rates are published below the calculator. Your current balance will be shown - this may be different to a balance.

Monthly Mortgage Payment Rate 1 1 Rate N x Mortgage Amount. The table below is updated daily with current mortgage rates for the most common types of home loans. Government loans including FHA and USDA loans charge mortgage.

Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. Loan Balance 5 Years. Our mortgage overpayment calculator uses the standard formula with fixed-rate mortgage loan.

The most common mortgage. You can cancel it once you pay your balance down to 80 of the homes value. Loan Balance 15 Years.

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments. Loan Balance 10 Years. Optionally provide your Taxes Insurance PMI and HOA fees to calculate a complete picture of your future mortgage payment.

In your current area homeowners are currently utilizing reverse mortgages to better enhance their retirement years. Enter the original Mortgage amount or the last mortgage amount when remortgaged. Quickly see how much interest you could pay and your estimated principal balances.

And thats all it takes to use this mortgage calculator with extra payments. Mortgage refinance is the process of replacing your current mortgage with a new. Current mortgage payment.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Mortgage interest is amortized so that you pay the bulk of your interest in the first years of your mortgage. Table for your.

Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. The cost of borrowing money from the lender. Original or expected balance for your mortgage.

A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Current 30 Year Mortgage Rates Available Locally. If you have an existing mortgage balance Ill need to know the amount we are going.

The AARP mortgage calculator can help you do just that. With that additional principal payment every month you could pay off your home nearly 16 years faster and save almost 156000 in interest. That said if you lack enough funds to shoulder the expenses its probably.

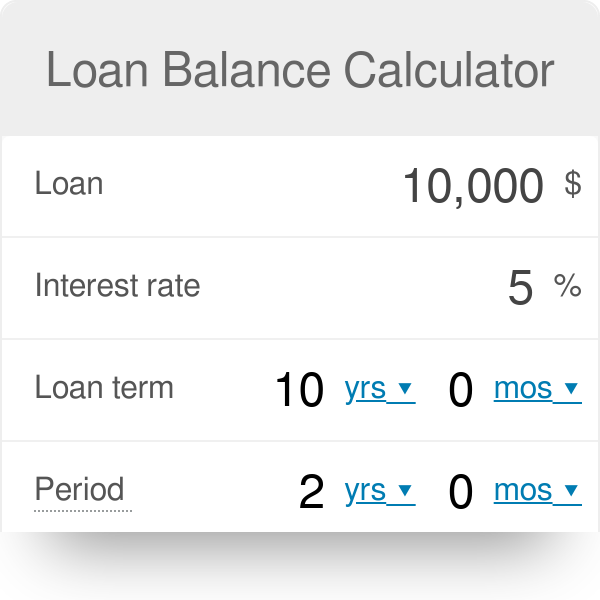

Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to. The principal is the balance of the home loan or mortgage to be paid off. This calculator will help you to determine the current loan balance of your mortgage based on the number of mortgage payments you have made.

Our mortgage calculator helps you estimate your monthly mortgage payments. You decide to increase your monthly payment by 1000. Thats a lot of cabbage.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. FRB consumers normally spend around 3 to 6 percent of their outstanding mortgage balance on refinancing. Early Mortgage Payoff Calculator.

Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter. As such it pays to know current mortgage rates. The loan calculator also lets you see how much you can save by prepaying some of the principal.

N The Number of Monthly Payments for a 10 year mortgage loan N 10 x 12 120. The mortgage balance is what you have left to pay on the principal amount you borrowed. 30-year fixed conforming mortgage.

Then choose one of the three options for enteringcalculating the number of mortgage payments made. 15-year fixed conforming mortgage. Historical Mortgage Rates A collection of day-by-day rates and analysis.

This includes refinancing fees as well as prepayment penalty costs. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis ie.

Its calculated as the home price minus the down payment. The unpaid principal balance interest rate and monthly payment values can be found in the monthly or quarterly mortgage statement. Calculate your monthly payment here.

Mortgage Calculator Found a home you like. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans. Term in years The number of years over which you will repay this loan.

You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. Use this mortgage calculator to estimate your monthly mortgage payments. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

Amount of the principal loan balance the interest rate the home loan term and the month and year the loan begins. Equity Built 15 Years. Compare week-over-week changes to mortgage rates and APRs.

How to use the loan amortization calculator. This does not include current home insurance or tax escrow. Freddie Mac During that time youll pay 200000 in principal plus another 125325 in interest for a total 325325.

To determine your home equity simply take your current property value and subtract the outstanding loan balance. The monthly payment principal and interest based on your original mortgage amount interest rate and term. For example if your home is worth 500000 and your loan balance is 300000 youve got a rather attractive 200000 in home equity.

See how changes affect your monthly payment.

Pin On Money Money Money

Mortgage Calculator With Down Payment Dates And Points

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

Discount Points Calculator How To Calculate Mortgage Points

Amortization Schedule Calculator Amortization Schedule Mortgage Payoff Pay Off Mortgage Early

Loan Balance Calculator

Excel Formula Estimate Mortgage Payment Exceljet

Credit Card Payoff Calculator Credit Card Payment How To Calculate Credit Card Payment Paying Off Credit Cards Credit Card Debt Payoff Credit Card Tracker

Riu43xx1v3nx0m

Personal Balance Sheet Net Worth Calculator Etsy Canada Balance Sheet Improve Credit Score Improve Credit

Printable Amortization Schedule Check More At Https Cleverhippo Org Printable Amortization Schedule

Credit Card Interest Rate Calculator Calculate Weighted Average Credit Card Interest Paying Off Credit Cards Credit Card Payoff Plan

Loan Amortization Schedule Simple Amortization Schedule Schedule Template Excel Templates

Mortgage Points Calculator Mls Mortgage Amortization Schedule Mortgage Calculator Mortgage

How To Calculate Your Net Worth Net Worth Financial Calculator Savings Bonds

Mortgage Repayment Calculator

Easy Excel Credit Card Payoff Calculator Debt Calculator Etsy Paying Off Credit Cards Credit Card Balance Credit Card Payoff Plan